The demand and supply for various types of loans, including mortgages, auto loans, and business loans, have experienced significant fluctuations in recent years, driven by a complex interplay of economic factors, regulatory changes, and consumer behavior. This article will explore these shifts in the U.S. loan market and their implications for borrowers and lenders.

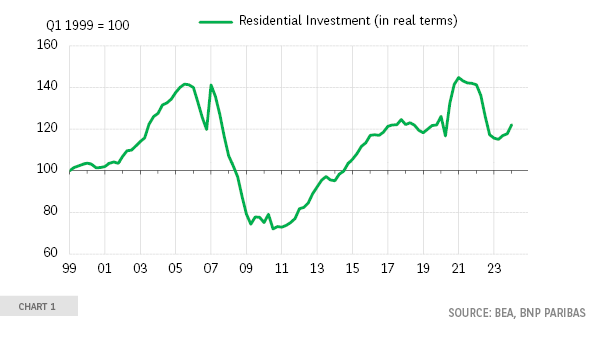

Rising interest rates: The Federal Reserve's aggressive monetary tightening in 2022 and early 2023 led to a surge in mortgage rates, significantly dampening demand for home purchases.

Affordability concerns: High home prices coupled with higher mortgage rates have made homeownership less affordable for many Americans, particularly first-time buyers.

Economic uncertainty: Concerns about a potential recession have also contributed to a decline in home purchase demand.

Limited inventory: A persistent shortage of existing homes for sale has constrained supply and supported home prices.

Tightening lending standards: Lenders have become more cautious in their underwriting standards, resulting in a decrease in mortgage originations.

Used car prices: The surge in used car prices during the pandemic and subsequent supply chain disruptions has made auto loans more expensive for many consumers.

Economic uncertainty: Similar to mortgages, economic uncertainty has led to a decline in demand for new cars.

Shift toward services: Changing consumer preferences, with a growing emphasis on services over goods, may be reducing demand for auto loans.

Inventory challenges: Automakers have faced challenges in securing semiconductor chips and other components, leading to production constraints.

Rising interest rates: Higher interest rates have increased the cost of borrowing for auto loans, impacting demand.

Supply chain disruptions: Many businesses have faced challenges due to supply chain disruptions, leading to increased borrowing needs for working capital.

Inflation: Rising inflation has put pressure on businesses' profit margins, increasing the demand for financing.

Interest rate sensitivity: Small businesses are particularly sensitive to interest rate changes, as higher borrowing costs can hinder growth.

Tightening lending standards: Lenders have become more cautious in lending to small businesses, especially those in high-risk industries.

Government support: Government programs such as the Paycheck Protection Program (PPP) have provided temporary relief to small businesses, but their long-term impact on lending is uncertain.

The U.S. loan market has experienced significant shifts in recent years, driven by a combination of economic factors, regulatory changes, and consumer behavior. While the demand for mortgages and auto loans has declined due to rising interest rates and economic uncertainty, the demand for business loans has been more resilient, supported by factors such as supply chain disruptions and inflation.

Interest rates play a crucial role: Rising interest rates have significantly impacted the demand for mortgages and auto loans.

Economic uncertainty is a major factor: Concerns about a potential recession have dampened demand for loans across various sectors.

Supply chain disruptions have affected multiple loan markets.

Government policies have influenced lending: Government programs such as the PPP have provided temporary relief to small businesses.

Looking ahead, the future of the U.S. loan market will depend on a variety of factors, including the trajectory of inflation, the Federal Reserve's monetary policy, and the overall health of the economy.

[1] Home Prices and Interest Rates Still Rising, Shutting Out More Potential Homebuyers

[2] The Market Dynamics Fueling the Great Housing Shortage

[3] The Federal Reserve keeps raising rates. That means it’s harder to get a car loan

Kai Cenat Under Fire: Twitch Star Faces Potential Ban for Distracted Driving

Chrisean Rock's Emotional Performance: Singing 'Yahweh' with Baby Son

Family-Friendly Snow Sports Adventures: Your Ultimate Guide

6 Best Robot Vacuum Cleaners for Effortless Home Cleaning

Thrilling Snow Sports Adventures for Families

The Delicious World of Chinese Cuisine

Strategic Education: Selecting a Major for Financial Prosperity

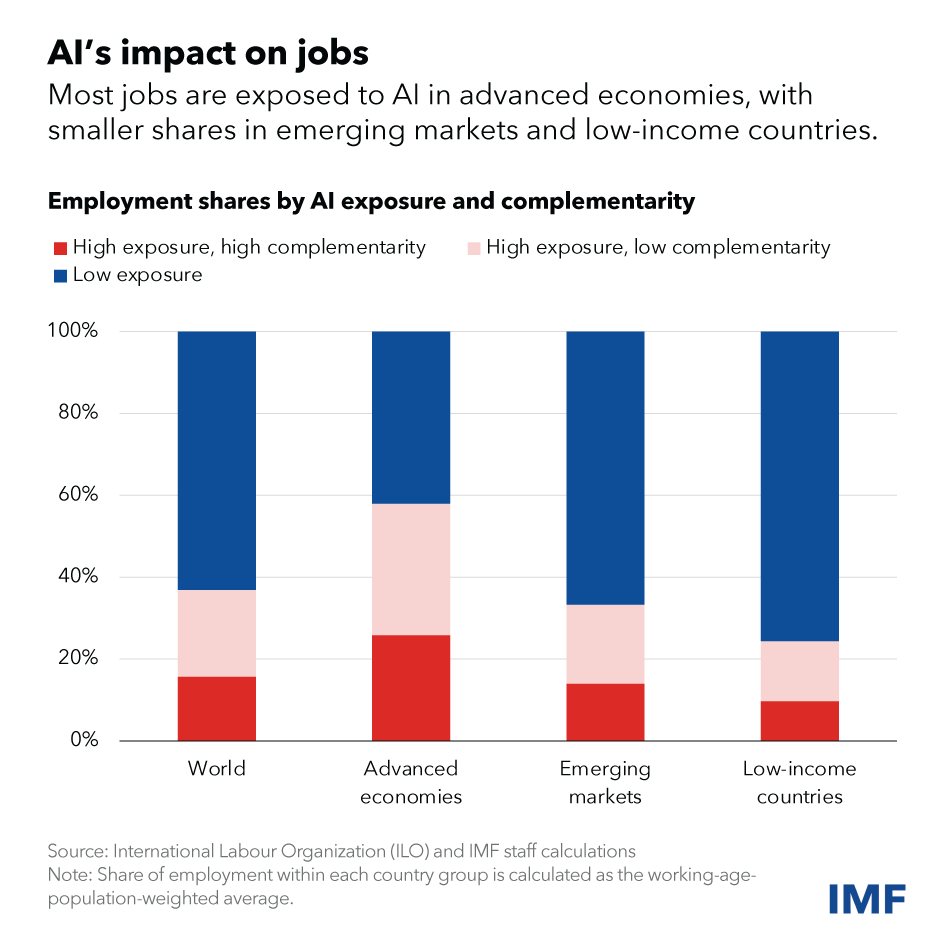

The Impact of Artificial Intelligence on Tech Stocks

Ultimate Guide to the Best Sweeping Robots of 2024